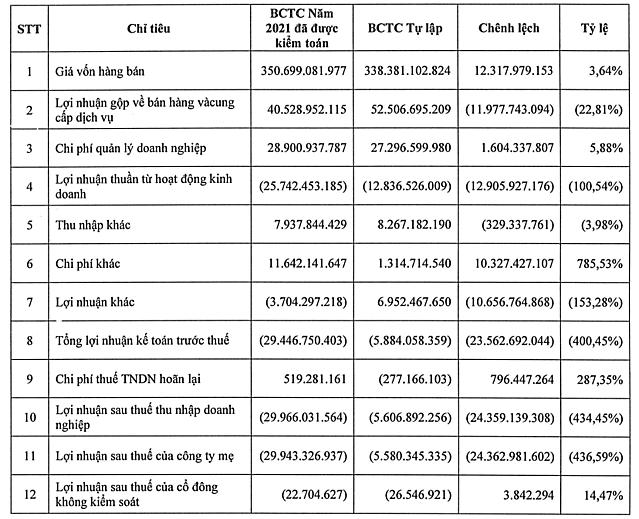

Viet Nat Medical Equipment Joint Stock Company (HoSE: JVC) announced a document explaining fluctuations of more than 5% in certain items between its 2021 independent and audited consolidated financial statements. The parent company’s after-tax loss was about 30 billion dong in the audited consolidated financial statements, 5.4 times higher than the independent report.

According to Viet Nat Medical Equipment’s explanation, gross profit after the audit fell 22.8%, mainly due to an increase in cost of goods sold by 12 billion dong (3.6%). The auditor requested not to change the depreciation expense for inventories of VND 10.5 billion.

General and administrative expenses increased 5.9%, as the prior year’s audited financial statements recorded additional expenses for other receivables and the provision for prepayments to vendors increased the provisioning rate as the debt aged.

Net loss widened by 12.9 billion dong to 25.7 billion dong. Other profit changed from a profit of about 7 billion dong to 3.7 billion dong, as other expenses increased by 785.5% – equal to 10.3 billion dong, as the parent company recorded additional expenses from the contract. Signed a business cooperation agreement with Tam Ann. Medical Examination and Treatment Joint Stock Company to invest in building and operating an international polyclinic at Nam Cao Street, Giang Vo Ward, Ba Dinh District, Hanoi. The project has been invested for less than 1 year, but due to problems between the project management and the residents, in order to limit the losses, the parties agreed to stop the implementation and record the costs and losses proportionately.

Viet Nat Medical Equipment assessed that the above changes increased its post-audit net loss by 24.4 billion dong to 29.9 billion dong.

The audit unit emphasized that as of March 31, Viet Nat Medical Equipment and its subsidiary had made a financial settlement of arrears including 59.3 billion VND and this item from the balance sheet according to the resolution of the board of directors. Keeping track of debts off the balance sheet does not reduce Viet Nat Medical Devices’ debt collection liability.

Bad debts, long-term and uncollectible from the monitoring table approved by the board of directors on May 6, Viet Nat Medical Equipment said about this. These debts are 100% provisioned in FY2021. The enterprise determines that this will not affect the ability to collect debts and benefits for these debts.

Problem solver. Incurable bacon specialist. Falls down a lot. Coffee maven. Communicator.