G20, Global Minimum Tax: Facts, Numbers, Opinions, Analysis, Circumstances

G20: The world economy has passed the minimum tax for big names, and by 2022, 70% of the world is united in its goal of vaccination against covid, but the debate on the fight against heat is still up: according to the first drafts of the summit final document, the 2050 deadline for a world to eject zero would have been abolished.

What is the global minimum tax?

The global minimum tax (at least 15%) at the heart of the Rome Statute is a tax aimed at ensuring more equity for multinational companies. That is, create more correspondence between the countries that receive the revenue and the countries that pay the taxes.

The first pillar of the global minimum tax

The first of the two cornerstones is about the taxation of hundreds of multinational companies (with revenues in excess of 20 20 billion), which are implemented not only in the states where they make a profit and in the states where the tax resides.

The second pillar of the global minimum tax

The latter predicts that governments in multinational countries with a turnover of at least 750 million will be able to levy at least 15% tax. In June, the G7 supported the proposal for a lower tax, and in early October it received the green light from 136 out of 140 countries on the OECD / G20 Inclusive Framework.

ISPI Report

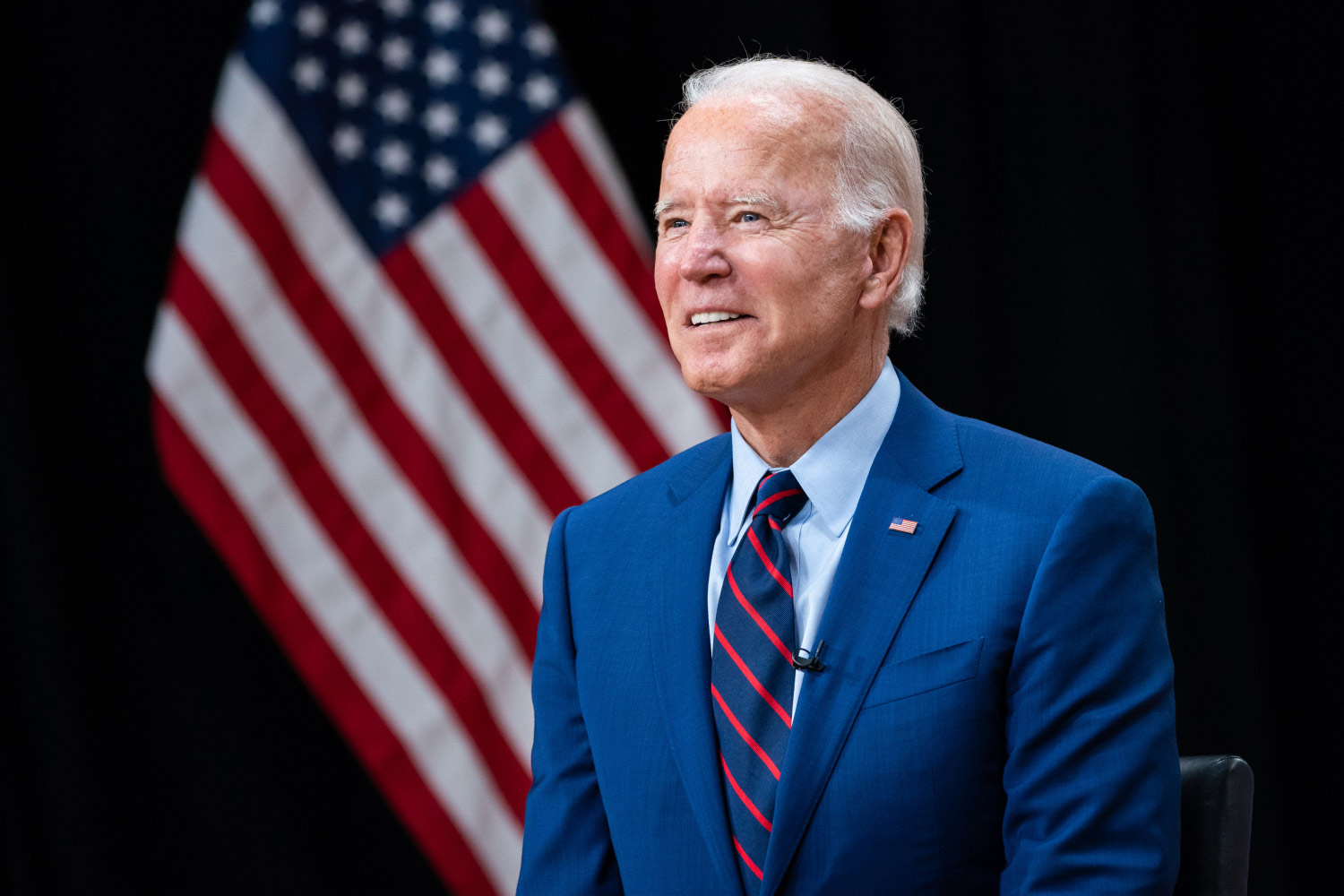

At a virtual meeting of the OECD, the U.S. proposal for a minimum tax for multinational companies received the green light in 130 countries in recent months. China and India have agreed to oppose the corporate tax exemption, which has already been approved by the G7, and an ISPI report reads: “US President Joe Biden’s proposal – after nearly a decade of negotiations – was doomed to face opposition from Washington – is based on two pillars, the multinationals. The exact rules are taxable, with a turnover of $ 20 billion and a margin exceeding 10% of revenue: a portion of their profits are approximately equal to about 20-30% of those profits, and companies are taxed in countries that generate revenue, and the second column applies to companies with a turnover of more than $ 750 million. Profits are taxed at a minimum of 15%.

Who said yes to the G20?

The agreement was reached at the G20 summit in Rome, he said today Print “This was made possible by the long-standing accession of Ireland, Estonia and Hungary. Kenya, Nigeria, Pakistan and Sri Lanka are not members of the agreement, but represent more than 90 per cent of the global economy. The expected revenue is at least $ 60 billion for the US alone.”

Liberal analysis

The choice of the “minimum tax” satisfies the protectionist aspirations of the United States, and from this point of view the path from Donald Trump to Joe Biden has not changed significantly, and the conservatism of European countries has no intention of limiting it. The burden of the state on the economy “, He wrote Liberal thinker Carlo Lottieri Free daily.

Use with satisfaction

Why is America satisfied? “Because there will be very little relocation for their businesses, so a lot of operations will be brought back; Other countries, as well, expect giants like Amazon and Facebook to be able to exploit the world for the profits they make. The total revenue of the states is over 120 120 billion. Clearly, the targets are the so-called “tax havens,” i.e., from Ireland to the Netherlands and Luxembourg – which, while adopting favorable rates, are attractive to the realities that are apparently aimed at reducing costs. And, in this way, compete exclusively “.

What do Italy and France expect from the lowest taxes?

In the opinion of the liberal intellectual, the decision of the major European countries to adopt a “minimum tax” is understandable: “It is difficult not only for France and Italy to face competition from very low tax realities. Review is required.

Sign up for our newsletter

Subscribe to our mailing list to receive our newsletter

Prone to fits of apathy. Unable to type with boxing gloves on. Internet advocate. Avid travel enthusiast. Entrepreneur. Music expert.