Opening the United States Web Tax. Janet Yellen, the first woman to head the U.S. Treasury, told G20 finance ministers that Washington was ready to abandon the “safe harbor” portfolio for multinational corporations that have so far held complex discussions on global tax reform between states. OECD members.

The change was announced by German Finance Minister Olaf Scholes, Has for some time been in favor of imposing a new tax on web giants Facebook, Google and Amazon. French colleague Bruno Le Meyer is of the same opinion: «This is an important step. It is under the jurisdiction of an international agreement to tax the digital giants. As this is an urgent matter, the goal is to find an international agreement by the summer of 2021. This is what the G20 has to deal with.

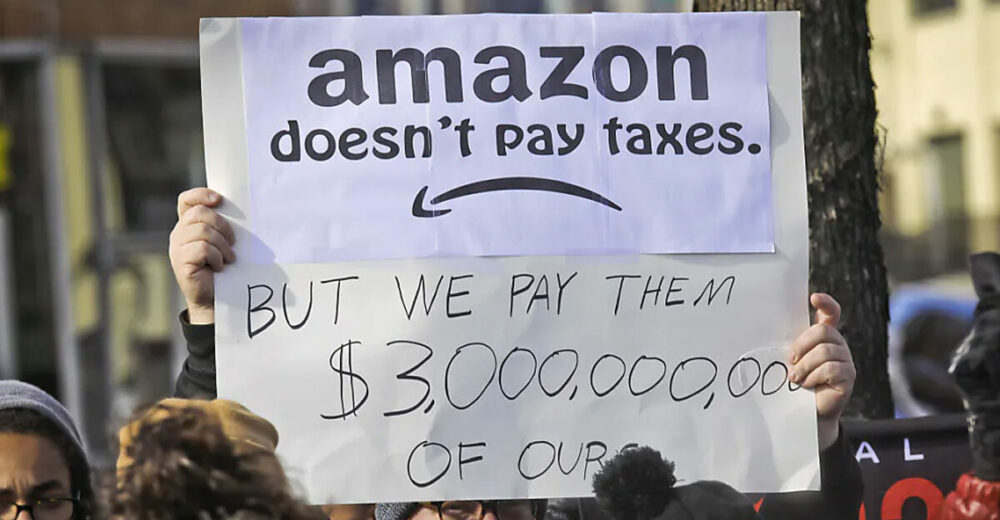

Read: Giants on the web, small to the tax authorities: only 64 million taxes paid to Italy

“Reform of the international tax system is an urgent issue in terms of the role of digital services,” said Finance Minister Daniel Franco. “Many countries have said they are in favor of a global solution, but the devil is in the details. Moving from an agreement on guidelines to a detailed one with many facets, small and large, will not happen in the park,” Franco explained.

The removal of one of the biggest hurdles from the negotiating table now paves the way for an agreement to revise corporate tax laws across the border, which the EU is scrambling for, but has previously strongly opposed the Trump administration. Finding a global solution is by no means easy. A statement reads, “The G20 will try to reach a consensus on this issue by mid-2021.”

Web giants such as Amazon, Google and Facebook spend most of their taxes in the European Union country where they are based. (E.g. Ireland, Holland, Luxembourg). In the highest-income countries, they often pay very little. The OECD has been working for some time on a two-pillar-based solution. Under the first, countries would be granted certain rights to tax profits made on the basis of sales within their jurisdiction. This would give not only the US tech giants, but also the US limited tax rights over European luxury goods companies. The second pillar is the global minimum tax rate that prevents countries from reducing corporate tax rates in an effort to attract corporate tax offices to their jurisdiction.

Prone to fits of apathy. Unable to type with boxing gloves on. Internet advocate. Avid travel enthusiast. Entrepreneur. Music expert.