The United States approves the agreement on web tax. The Biden administration has suspended the responsibility of six countries, including Italy, to allow more time to reach an agreement on the imposition of international taxes within the OECD and the G20.

The duties to be imposed on Austria, India, Italy, Spain, Turkey and the United Kingdom were in response to their national tax on digital services. The European Union Commission welcomed the decision. The 25% tariff would affect a total of $ 2 billion in imports, of which $ 800 million is from the United Kingdom and $ 300 million from Italy and Spain.

The Trump administration launched an investigation in June 2020 into the imposition of a tax on web giants imposed by various countries around the world, but he too suspended the tariff, which was due to take effect on January 6.

In Italy, revenue from digital services tax in 2020 was limited to: just 233 million euros. The information was presented by Finance Minister Daniel Franco in response to questions from deputies in the chamber. “The deadline for paying the first installment of the 2020 tax has been extended to May 17, 2021, and the deadline for sending the 30th annual declaration is June 30,” explained the owner of the Video X X Setembre Department. “To date, F24 has disbursed 98 million payments through May 24 to 40 issues, 40 joint-stock companies and 9 expat issues, and recorded direct transfers to the Treasury for 135 million by the State Accounting Office, hence the 2020 digital services. The total tax revenue will be 233 million.

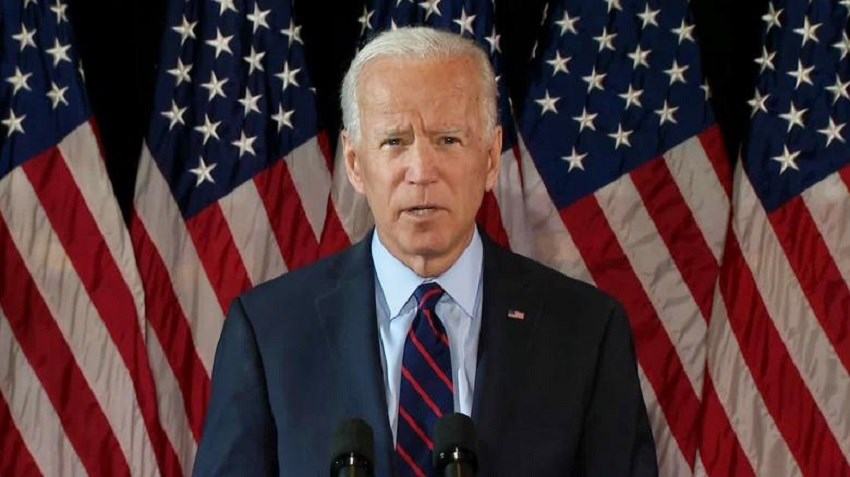

Washington has paved the way for a solution with a proposal to keep the global minimum tax rate at 15%. The initiative is part of US President Joe Biden’s financial agenda to help increase corporate tax rates and taxes on foreign profits of US companies. However, some countries, such as Ireland, were soon skeptical.

“As Made in Italy exports more than doubled in the US (+ 113%), it was important for six countries, including Italy, to suspend additional tariffs for six months in the wake of digital tax disputes,” Coldiretti said, citing the latest Estate data on foreign trade in April. (all rights reserved)

Prone to fits of apathy. Unable to type with boxing gloves on. Internet advocate. Avid travel enthusiast. Entrepreneur. Music expert.