2021 June 12 Saturday

U.S. loopholes in criticism

“Don’t be surprised if billionaires are on the rise”

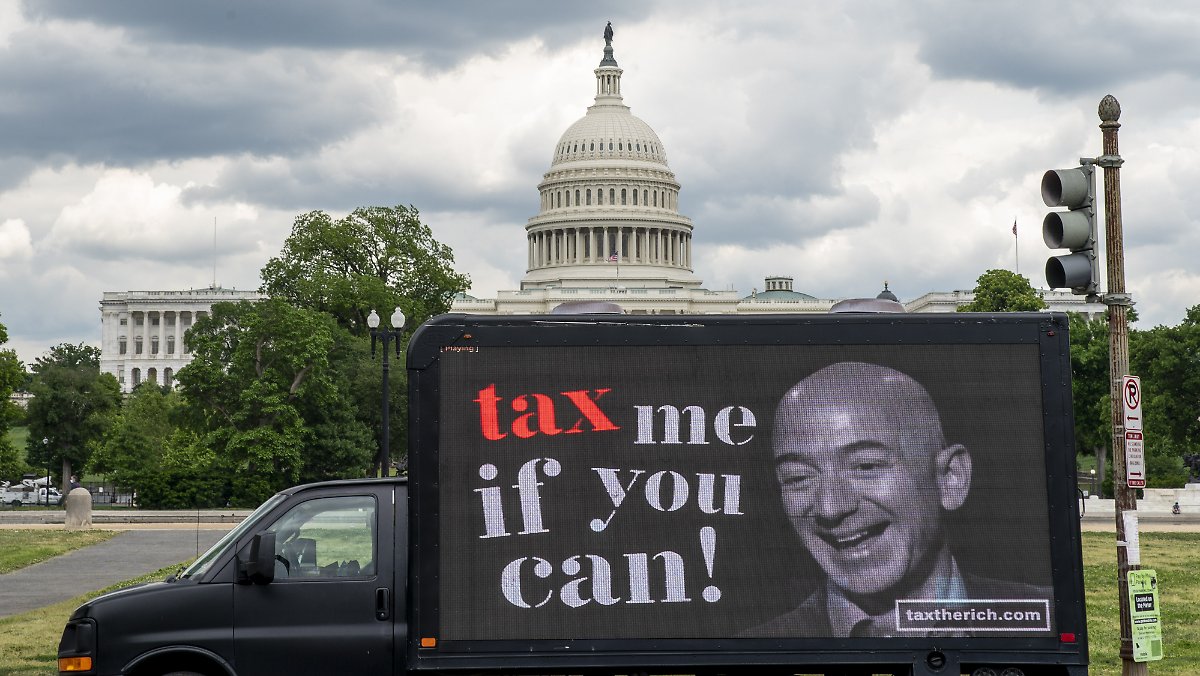

Bezos and Co-Pay often pay tax authorities in the US only billions of dollars in their wealth growing every year. In an interview with Capital.de, tax expert Stephen Bach gave good reasons for this. He explains why the situation is still unfair and how to improve the system.

Mr. Bach, do you understand the excitement of the richest people in the US paying such a low tax?

Stefan Bach: Well, in principle this is cold coffee, although accurate tax data are now available. Warren Buffett joked that his secretary had a higher tax rate than he did.

Why?

The income of many super-rich is rarely distributed in the private sector and is therefore not subject to progressive income tax. They collect their monster revenue in their companies or structures. The withholding tax or similar tax in other countries is levied only when they recognize and distribute the profit. But it does not distribute profits, but invests more.

Labor income is taxed higher than capital income in Germany and the USA. It should create unrest.

Yes, but it is also important not to tax income twice. German companies already pay up to 30 percent in taxes on corporate profits. Once the owners pay their wages, they pay 25 percent flat tax and solos for the remaining 70 percent.

So the incentive is to keep the profit with the company.

Exactly. This is how we encourage real investment, for example among German medium-sized companies. But we are encouraging the wealthy to acquire wealth – regardless of whether they invest at home or abroad. You should not be surprised if the number of billionaires in our country is always increasing. You can re-invest your profits, pay only corporate taxes, but no withholding tax or progressive income tax.

Does the low tax on equity investments always encourage investment?

The difference between Bezoszmok and our good German medium companies is that the corporate tax burden can be as high as 30 percent as a result of investments in medium companies. Elon Musk and Jeff Bezos are also not paying much attention to their success. The U.S. imposed heavy taxes on domestic corporate profits. In Europe and Asia, musk or bezos are taxed, and they are diverted to tax havens that tax corporate profits through Ireland, Luxembourg, and other countries. See Buecher.de and Amazon. Some had to pay taxes on their profits, while others did not. This is definitely an unfair competitive advantage. That’s why we get an international minimum tax for companies.

So this is a dilemma. On the one hand, the wealth of the rich continues to grow because they can reinvest their profits at a lower tax rate, and on the other hand, investments are tax-friendly. How can that be changed?

You can bring back large investors’ income to income tax. But it is difficult. Or you can tax wealth and keyword wealth, but that too has its problems. Ultimately, this is always a matter to be settled: fairness or efficiency? This also applies to inheritance tax. Minor inheritances are tax-free. The rich with ordinary wealth should pay ten per cent faster. The super-rich with large companies and holdings are largely generic. But if you approach it in practice, you can do a lot. Many super rich see the connection and are willing to pay more taxes again for the public. You should not over-tax where there is financial damage. In real estate, for example, Germany is a tax haven.

What tax increase is actually possible without affecting the economy?

The combination of wealth, inheritance tax, high capital gains and real estate taxes generates between 20 and 30 billion euros a year without adversely affecting investment, jobs and growth. This money should be used to get rid of the burdened middle class, which is burdened with social contributions and income tax.

Roland Lindenblatt spoke with Stephen Bach

Interview first Capital.de Published.

Prone to fits of apathy. Unable to type with boxing gloves on. Internet advocate. Avid travel enthusiast. Entrepreneur. Music expert.