Bermuda Comparison

Biden is attacking Switzerland as a tax haven, which is the USA’s own fault

President Biden calls Switzerland a tax haven, and Federal Councilor Yuli Mrerter accidentally – there is an argument.

Compare Switzerland to Bermuda: US President Joe Biden.

Joe Biden wants to get rid of tax evasion – which means the new US president is Switzerland. In a speech to Congress, he said: “Many companies are evading taxes at tax sites -” in Switzerland, Bermuda and the Cayman Islands. ” In Switzerland everything is rejected. Finance Minister Yuli Murer has been quoted on Swiss television as saying that Biden wrote an outdated speech and that he had read it, but that the facts were outdated. Mason unbridled about the most powerful man in the world:

“I think things like that happen. President Biden is new.

No president in American history is more experienced than Biden. He was vice president for eight years and 30 years in the Senate before that. Biden’s facts are by no means obsolete. According to a new study by the Tax Justice Network, Switzerland ranks four countries among the worst tax havens. They formed the “tax evasion axis”.

General opinion about US President Biden: Federal Councilor Yuli Maurer

World Champion in the Use of Tax Stations

But Murray could reasonably say: the US should take its own nose. Because this is true. Americans have personally written laws that enable their multinational corporations to turn large profits into tax havens. Your multinational companies use the most careful tax systems in the world and are world champions in tax saving.

Tax economist Gabriel Sukman described how this world championship came about in a study. Until 1996, the US was like any other rich country: it had anti-abuse laws. It was difficult to change profits. Since 1996 it has been very easy. The Treasury Department had issued new rules. It was now enough to follow the “check the box” rules: tick a few boxes on a form and done. As soon as they came into force, the new laws had a miraculous effect. Soon, U.S. multinationals tripled profits in tax-efficient Ireland.

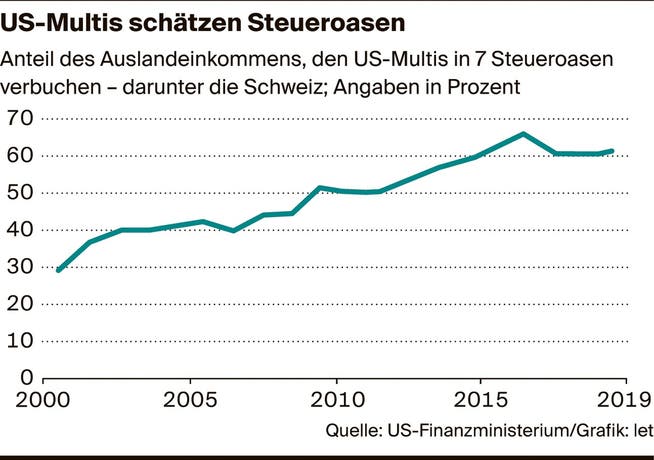

It was then that US multinationals discovered their love for tax sites. Today no one uses them regularly. In no other country do multinational companies book their foreign profits at higher tax points than they do in the USA. Most recently, it was $ 6 at tax points for every $ 10 in foreign profits. Multinational companies from Europe lag far behind Americans. They use tax systems almost half as carefully as their American counterparts. The European Union has maintained strict anti-abuse laws. On the other hand, the United States has “check box” rules.

An idea that is not completely crazy, at least

Why did the US allow its multinationals to be world-class in their use of tax bases? Sukman should ulate on this question. The Treasury Department may have intended something different than the “check box” rules introduced in 1996. It wanted to increase revenue. On the other hand, this was a big mistake, but the idea was not crazy.

The U.S. levies taxes on all their foreign profits by their multinational companies. This tax will be paid as soon as foreign profits return to the US. Prior to this, taxes already paid in foreign countries may be reduced. For example, if Apple already pays a lot of taxes in Germany, the US has less left. But Apple pays less taxes in Ireland and more is left. That was the idea, and in 1996 it seemed credible.

Just hoping for a boom in investment: Former President Trump

In practice, Apple has invested heavily in Ireland and does not want to return the money. Other US multinationals have done the same. Last but not least, Donald Trump came along and made everything short and sweet. He cut taxes drastically. When foreign profits were brought back, multinational companies now paid much less. Trump believed there would be a big return on funds. Multinational companies will invest unnecessary amounts in their home country. But Trump failed. The investment jump was not effective.

Biden wants to end American love affair with tax havens – consequences for Switzerland. “Of course, the USA should be partially blamed,” said Gabriel Sukman. The tax economist is a student of French star economist Thomas Pickett. Sukman says:

“It is the political decision of the USA to allow multinational companies to shift their profits to lower tax havens.”

Prone to fits of apathy. Unable to type with boxing gloves on. Internet advocate. Avid travel enthusiast. Entrepreneur. Music expert.