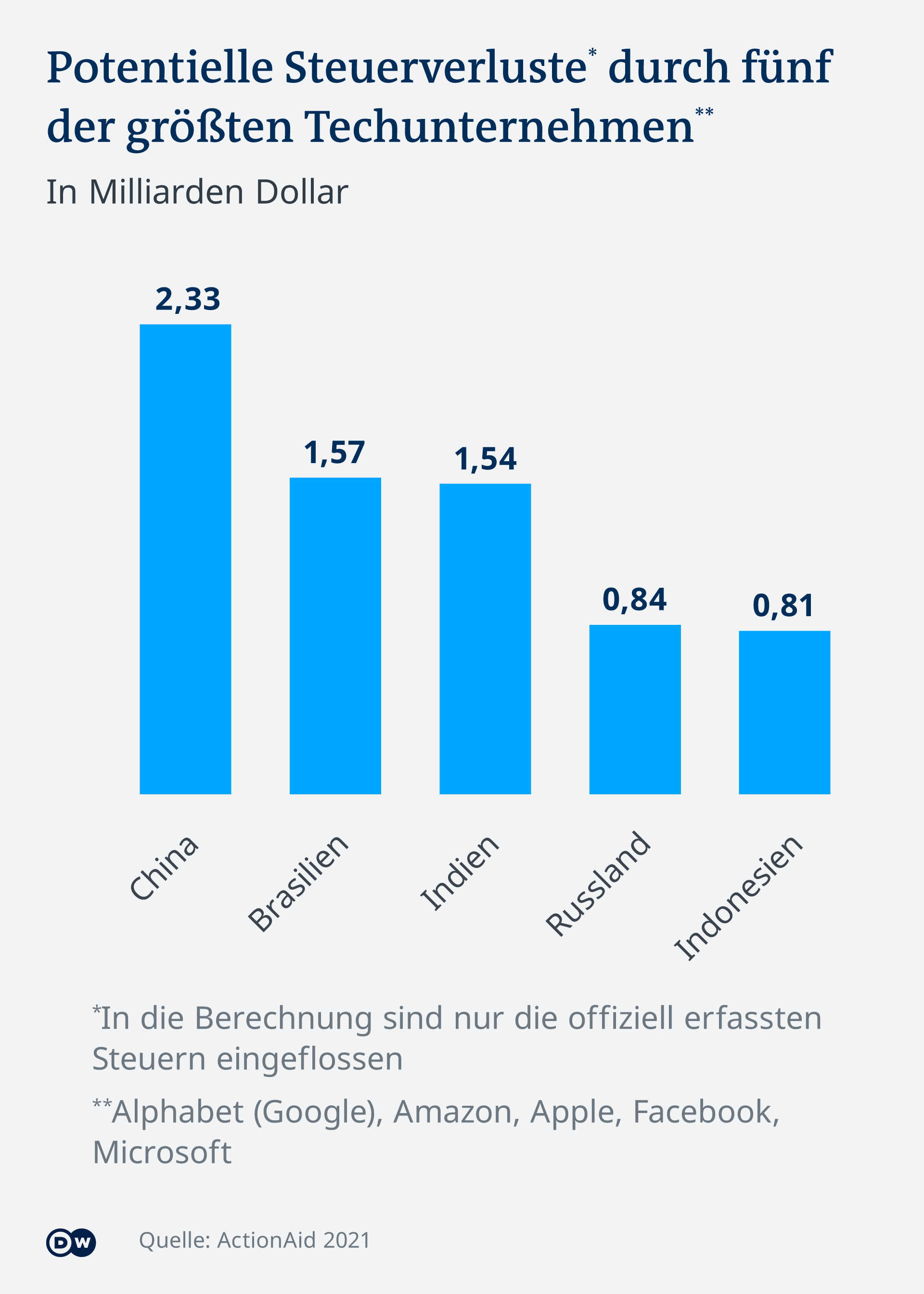

First: Twenty large industrialized nations could earn the equivalent of about 26 26 billion a year – and only from the top five tech companies – Google, Apple, Facebook, Amazon and Microsoft. The NGO comes to these figures Action Aid. System The system has stopped working. We need a global tax reform, says Anders Dalbeck, the organization’s tax expert, who finances individual contributions and money from governments and foundations.

The NGO study comes at a time when the European Union is once again drawing a short straw against overpowering corporations from the USA. The European Commission’s order was overturned by an EU court last week. This should actually force Amazon to pay taxes in Luxembourg. We will carefully review the judgments and consider possible follow-up action. A lawsuit against Apple for tax evasion in Ireland ended in a similar manner. Here, too, the European Union failed. The process is currently at a high level – before the European Court of Justice.

Billions through tax tactics

In terms of taxes, we can also talk about the failure of crores of rupees. Recently, the Luxembourg parent company Amazon even paid 56 million euros in taxes to Amazon for its European business. Although the Pandemic Group’s sales were allowed to grow by a third to 42 billion euros. The EU tax authorities came in empty-handed.

How can that be? Resourceful tax experts move profits, replace headquarters and reinvest the profits directly, leaving tax investors with nothing left. They use terms like “double Irish” or “Dutch sandwich”. Sven Geegold, a member of the European Parliament of the Greens, has repeatedly said that Germany loses a quarter of its corporate tax revenue to tax sites.

Andrews Dolbeck from ActionAid says the untouchable tax potential of the digital economy is enormous. Governments can generate huge additional revenue not only in industrialized countries but also in developing and developing countries. DOLBECK: p As the financial needs of governments in the health sector increase pandemic, additional funds are now needed. This is one reason why Action Aid is considered in its report Mission recovery It is noteworthy that the additional tax revenue for a double vaccination dose is sufficient for each person in the world.

Especially popular with large corporations: Caribbean tax havens

A global tax should fix it

NGO’s demands go further: ActionAid proposes 25 percent global corporate tax. At the same time, they agree with SiteGeest: US President Joe Biden turned to the European Union in April and called for a reversal of international tax policy: the headline of an essay entitled “End the race to undercut the world,” and the U.S. Treasury suggests that the global minimum tax rate be 21 percent. Earlier, US Treasury Secretary Janet Yellen also spoke in favor of a minimum tax rate, which was approved by the finance ministers of Germany and France.

Businesses want global minimum tax – Joe Biden

At the end of the day, the number provides information about what companies should pay in bulk. So, if you pay less than the minimum tax in a country, you have to pay the difference in your home country. One Caribbean island levies a five percent tax, while another 20 percent must be paid in the head country. Reduce profits in high-tax countries and move to a lower-tax area, and then it won’t work. Of course you need a critical mass for this. In particular, the USA, Canada, EU countries and some major Asian countries should participate. Big companies are headquartered here, ”Dalbeck said in an interview with DW.

For decades, corporate tax rates have actually known only one direction: downward. Due to international competition, the average tax rate on corporate profits is just over 20 percent. In the 1980s, they were still 40 percent. That is why ActionAid requests at least 25 per cent, as many countries will have to adjust to lower rates if the tax rate is higher.

New calculation formulas are needed

The world needs money. Around the world, epidemics and recessions have emptied state coffers – especially in developing and developing countries. “The way tax systems are currently viewed, it is very difficult for these countries to get taxed,” says Dalbeck. “That is why we are asking countries outside the global north to consider other measures for tax collection.”

Some African countries, such as Nigeria, Kenya and Sierra Leone, deduct pre-determined tax rates directly from the turnover of large tech companies for certain offers – for example streaming, social media or the like. According to the OECD, 40 countries around the world are known as digital service taxes. For example, India introduced the limit: Users and revenue from India. If these are above certain values, tax is payable. So tax strategies should be less important.

A few people around the world are still vaccinated – especially in developing and developing countries, where there is a lack of money for extensive immunizations.

In its report, ActionAid argues for a global tax system that meets the needs of developing and developing countries under the auspices of the United Nations. Activity Countries where economic activity takes place have the right to impose taxes, ”says Dalbeck. But the organization is real: in the near future, such complex rules will not be possible.

For now, the global minimum tax rate and national solo efforts should begin. The timing of such an action certainly seems appropriate. The USA and the European Union want the Pandemic winners to share in the cost of the crisis. The global minimum tax may come in the summer. You can almost be sure: tax experts from Amazon, Google, and Co are already working to optimize these requirements.

Prone to fits of apathy. Unable to type with boxing gloves on. Internet advocate. Avid travel enthusiast. Entrepreneur. Music expert.