An author, an Italian-American, a Nobel laureate, an entrepreneur of the new millennium. Here are 4 characters who wrote the history of microfinance

Microfinance aims to provide a banking service to low-income people or social groups, without which there is no financial offer, giving them the opportunity for redemption and success. “After eight years in Russia, I decided in 2008 to develop important local microfinance programs at the European Bank for Reconstruction and Development (EBRD). Micro CapitalThe microfinance fund for small and medium enterprises focuses only on the microfinance fund. I believe SMEs are the most dynamic part of the economy, ”he explains Vincenzo Trani, President of Micro Capital.

However, “Microfinance is not a new concept. In fact, small microcredit operations existed in the eighteenth century. Here are 4 characters that marked its history more than any other.

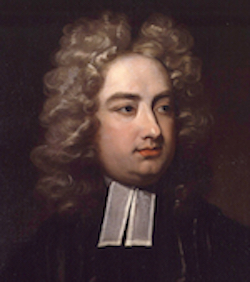

Jonathan Swift (1667-1745), charitable loans

Many will remember him as the author of this Gulliver’s TravelsBut Swift was not just a famous Irish writer. Anglican pastor of heterodox positions and masters of English satirical prose; Swift was also the founder of Irish loan funds, Established in Dublin in the early eighteenth century to provide credit (unsafe) to the city’s poor. Initially activated on a charitable basis, loan funds continued to operate throughout the nineteenth century, playing a positive role in alleviating Irish poverty.

Amadeo Peter Giannini (1870-1949) ei “Little Companions”

Born to Ligurian immigrants in California in the late 19th century, Giannini took an interest in a small San Francisco bank from her father-in-law. Innovative ideas that led to the confrontation with the management of the bank and are remembered today as the father of retail banks, In 1904 he founded the Bank of Italy, which would have exempted “small friends” or hard-working migrants from other financial services.. Giannini offered savings accounts and loans to people who were hitherto financially marginalized, not by wealth but by nature. In 1928, the Bank of Italy merged with the Bank of America in Los Angeles, later renamed the Bank of America.

Muhammad Yunus (n. 1940) ei microprestiti

Younus is a Bangladeshi social entrepreneur, banker, economist and civil society leader. Founder of Grameen Bank in 1983 (The world’s first bank lending is based on trust, not solvency) In 2006 he was awarded the Nobel Peace Prize. Younes is considered to be the father of modern microcredit, which was theorized as a way to save the country from the severe famine that hit Bangladesh in the wake of the 1974 violent floods. Yunus realized how far the traditional economic system was from reality. So, he decided to take to the streets to analyze the economy of a local rural village Conclusion that poverty is determined not by the ignorance or laziness of the people but by the lack of support from the economic structure of the country.

Renault Laplanche (b. 1970) and consumer lending

Laplanche is an American entrepreneur born and raised in France. The founder of a tech company that was badly affected by the 9/11 attacks later bought Oracle, In 2006, Laplanche co-founder Lending Club, a peer-to-peer lending company, transformed the banking system to make credit more accessible. And the most profitable deposits, eliminating the role of intermediaries that traditional banks have so far held. Launched via Facebook, the Lending Club is today the largest online marketing center in the world, connecting borrowers and investors.

Cookies help to enhance the experience on the site.

By using our site, you agree to the terms.

Prone to fits of apathy. Unable to type with boxing gloves on. Internet advocate. Avid travel enthusiast. Entrepreneur. Music expert.