A wave of texts, emails and phone calls. Between March 5 and June 26, 2020, David Cameron was actively involved with former colleagues in the British government and senior government. In all, the former British Prime Minister has contacted the state’s top officials fifty – six times, from Chancellor of Exchequer to number two in the Bank of England, including ministers and senior officials. Objective: To change the rules of emergency loans granted by the State during the Pandemic, in order to benefit Capital in the Greenhouse where he worked. He was paid for it “Very high”He admitted that he received 180 180,000 a year as prime minister.

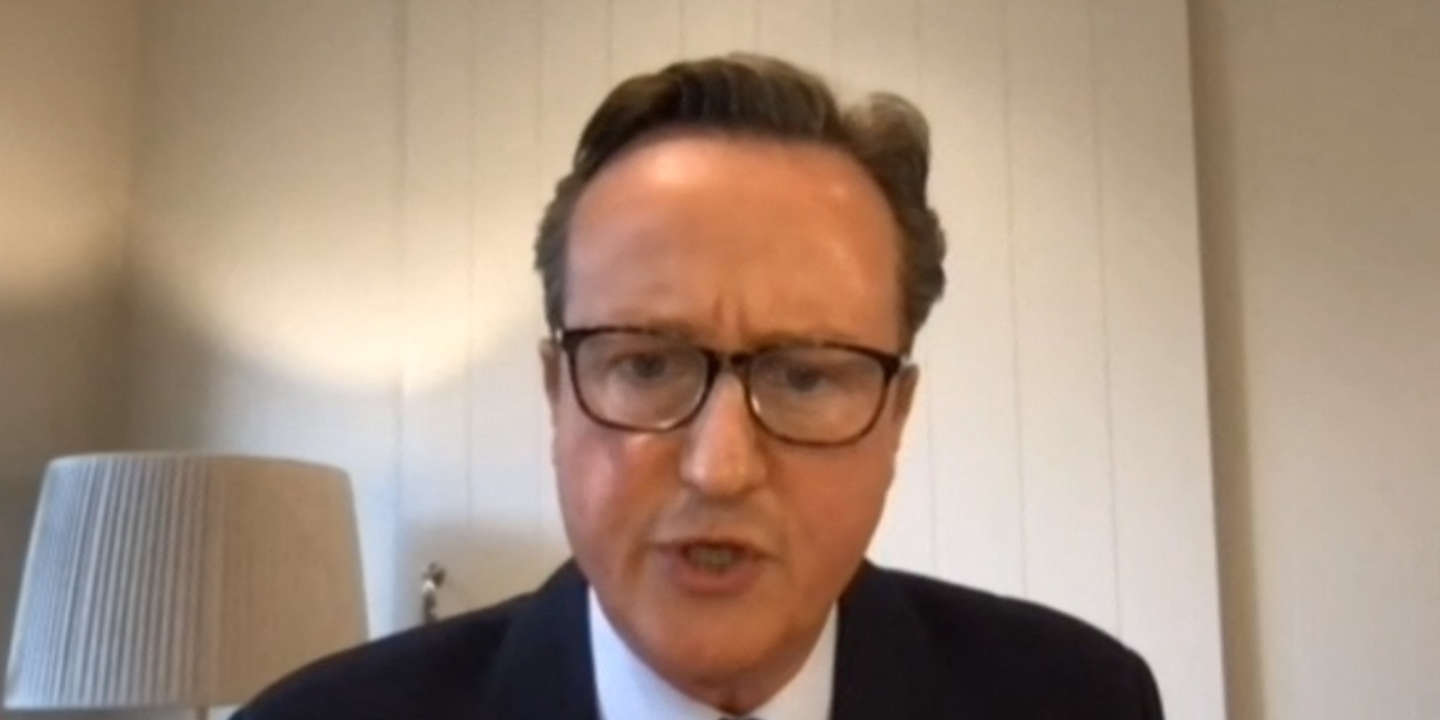

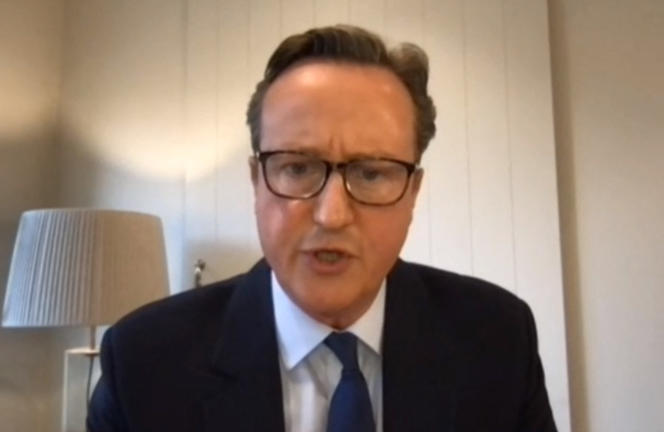

Following his departure from Dominion Street in June 2016, the day after the Brexit victory, Cameron was summoned before a parliamentary committee on Thursday, May 13. For two hours, video conferencing, his financial motivation, lack of judgment, and the use of the company’s private jet were attacked.

“The Greens used you, took advantage of your reputation and dragged the reputation of the Prime Minister’s Office into the mud”, Labor MP Rushanara Ali

“Your fame is in pieces, Attack Labor MP Rushanara Ali. The Greens used you and exploited your reputation and dragged the reputation of the Prime Minister’s Office into the mud. You have agreed to play the game. It is extremely frustrating. “ MEPs surprised by signing message to Treasury UK Permanent Secretary Tom Scholar: , Love, DC (“I kiss you, DC”). What is the relationship between two men who surprise a member? “I always sign my messages.”, Mr. Cameron replied.

If there had been, the case would never have been made public Greens has never experienced a major bankruptcy In March. Founded in Australia’s Lex Greens and has been living in the United Kingdom for over two decades, the firm was a financial institution specializing in factoring (including money paid to a company’s clients and moving forward to facilitate treasury). But the man claimed to have recreated the recipe thanks to new technologies. The truth known today is that adventure loans to clients with poor credit qualifications increased in the greenhouse, until the house of cards collapsed.

You have 57.22% read this article. The rest is for subscribers only.

Musicaholic. Twitter guru. Total bacon fanatic. Zombie ninja. Freelance student. Coffee fan. Gamer.